Foreign suppliers can fulfil their industrial co-operation obligation by completing development projects where they contribute technology or advisory services to a Danish company.

Apply for a pre-approval of a development project

The Danish Business Authority must preapprove development projects before they are launched. To apply for a pre-approval the foreign supplier must fill out a special template for the purpose in which the project is described. The Danish company involved in the process must commit to the project description before it is sent to the Danish Business Authority.

Guidelines for fulfilment through development projects

Approval of multipliers

For development projects, the Danish Business Authority can approve multipliers for the transfer of technology, software, etc., funding of development projects, advisory services, and/or making facilities available.

Multipliers can be approved if the specific contribution is deemed to be more valuable to the Danish company than selling off-the-shelf defence products or services to the supplier. In such a case, the obligation can be reduced by a multiplier greater than one.

The multipliers are assessed based on the type of contribution:

| Contribution | Multiplier |

Examples |

|---|---|---|

|

Transfer of technology, software, etc. |

up to 7 |

The foreign supplier transfers technology which can be used by the Danish company for the development project and which can be at the company’s disposal afterwards |

|

Transfer of funding |

up to 5 |

The foreign supplier pays the Danish company’s costs of the development project |

|

Advisory service, technical assistance, etc. |

up to 5 |

The foreign supplier places its own experts or external consultants at the disposal of the Danish company |

|

Making facilities available |

up to 3 |

The foreign supplier places its facilities at the disposal of the Danish company, e.g. proving grounds for testing prototypes or an exhibition booth at a trade fair |

|

Follow-on sales |

1 |

The foreign supplier buys or brokers the sale of products or services from the Danish company |

Follow-on sales

In development projects, the Danish companies may have developed new defence products or services. The Danish Business Authority can approve the follow-on sales of the product or service developed in the project to the foreign supplier or third parties as fulfilment of the obligation for industrial co-operation. The purpose is to anchor the new competencies and capabilities developed in the project.

It is a condition that the follow-on sales only relate to products developed in the project. Under the 2021 administrative guidelines follow-on sales can be approved up to 10 years following the conclusion of the development phase of the project. The ICCs period of performance will naturally limit the follow-on sales if this is less than 10 years.

Milestone bonus

The Danish Business Authority can approve a milestone bonus for follow-on sales in development projects, as an incentive mechanism for the foreign supplier. The milestone bonus will be released when a pre-defined target for follow-on sales of the product or service developed in the project is attained within a set timeframe.

Under the 2021 guidelines the milestone bonus will cover up to 100% of the value of the follow-on sales from the Danish company to the foreign supplier or third parties. For development projects under the 2014 guidelines, the milestone bonus covers 50% of the values of the follow-on sales have to be achieved within three years of the conclusion of the development phase of the project.

The value of the follow-on sales, as well as the milestone bonus, will count as industrial co-operation and be offset against the foreign supplier’s obligation for industrial co-operation.

Development projects must pass an assessment of competition

The Danish Business Authority conducts an assessment of competition for development projects submitted under industrial co-operation contracts based on the 2021 guidelines.

The screening of a development project is conducted before the project launches and in relation to the individual project. The screening model assesses whether the development project in isolation poses an unproportionate risk of undermining the competitive environment of the whole of EU’s civilian Single Market.

For the Danish Business Authority to process the assessment of competition, the Danish companies will have to report additional information to the Danish Business Authority when applying for a pre-approval of a development project. This will include:

- Civilian/military percentage of turnover

- Estimated profit rate in the project

- Civilian product portfolio

- Turnover on certain civilian products

The information will be reported directly to the Danish Business Authority.

Valuation of technology transfers from foreign suppliers

For projects under the 2021 administrative guidelines, the Danish Business Authority uses a set method for the valuation of technology transfers based on established accountancy practice: The “Relief from royalty” method.

The relief from royalty method originates in accounting and is used to estimate the fair value of intangible assets, such as technologies, brands, patents, etc.

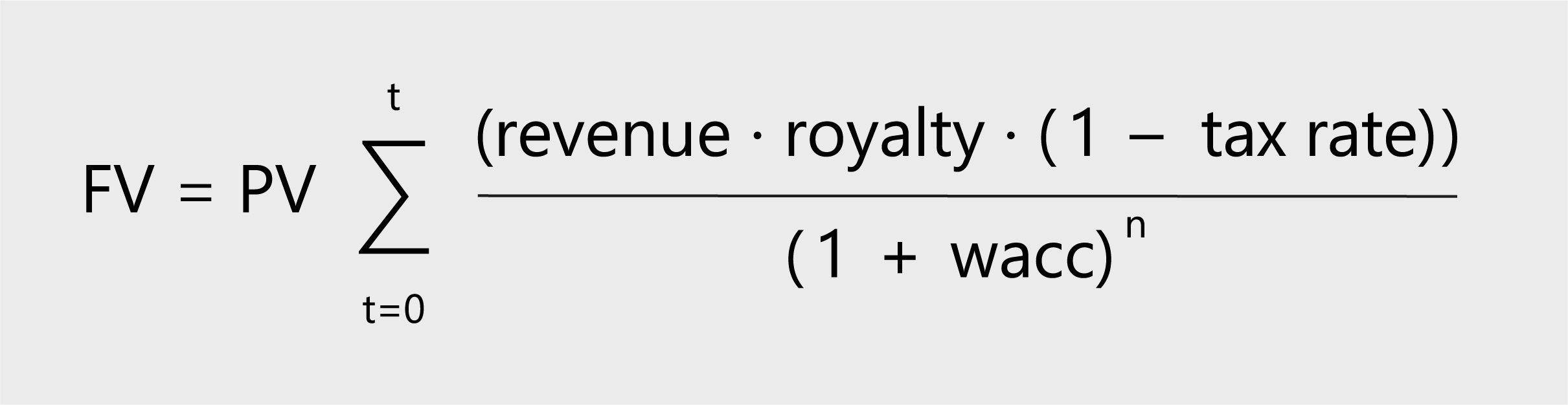

In industrial co-operation development projects, the method is used to estimate the value of the technology based on the expected follow-on sales for the Danish company in the project. The method assumes that the value of an asset can be estimated as the present-day sum that a company would be willing to pay in license fees for using an asset (the technology), which the company does not own. The cost savings of not having to pay the license fee is discounted to present day value based on the forecasted future revenue stream for the DK company, factoring in parameters reg. a probable royalty rate, the weighted average cost of capital (WACC) and the Danish corporate tax rate. In defining the parameter values of WACC and the royalty rate, the DBA has made an overall assessment considering the defence industrial market conditions and the special nature of a requirement for industrial co-operation.

Equation for calculating the fair value of a technology transfer

The purpose of applying the relief from royalty method is to ensure a fair valuation of technology transfers in industrial co-operation projects and thereby the build-up of necessary defence industrial capacity in the Danish defence industrial base. Furthermore, the method will ensure an efficient and transparent administration and equal treatment of the foreign suppliers.